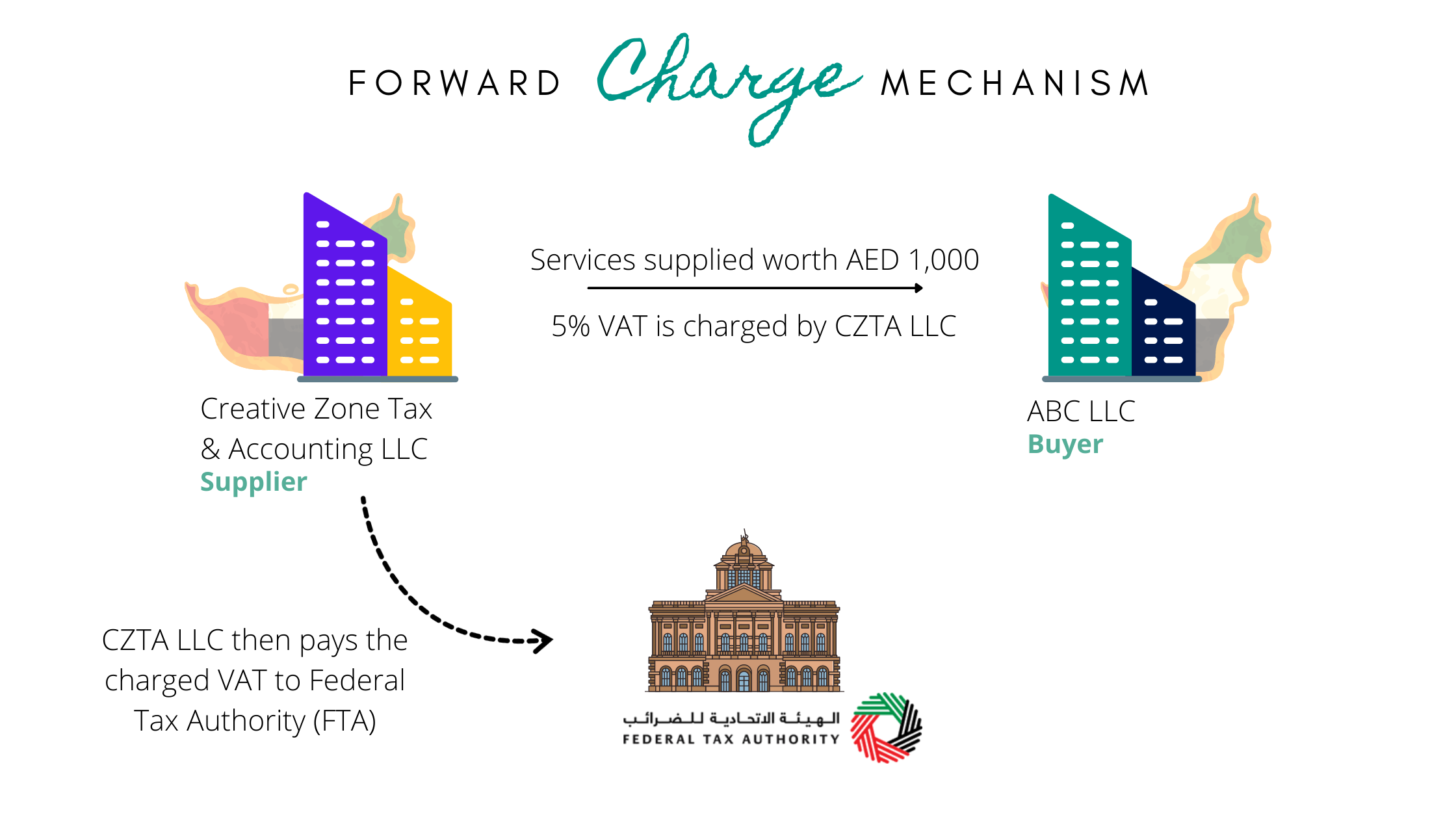

The UAE VAT Law states that the person making taxable supplies, i.e. the supplier, is responsible for levying, collecting and paying tax to the government. A registered supplier must charge VAT whenever he makes a taxable supply and pay VAT to the UAE government. The forward charge mechanism refers to the process by which a registered supplier collects tax from his customers. For instance, Creative Zone Tax & Accounting LLC provided accounting services worth AED 1,000 to ABC LLC and charged VAT of AED 50 at the rate of 5%. Using the forward charge method, Creative Zone Tax & Accounting LLC is collecting VAT of AED 50.

UAE VAT Law and Executive Regulations, however, specify that certain types of supplies must be subject to Reverse Charge Mechanisms for VAT purposes.

Let us first examine the concept of reverse charge VAT before we look at those supplies that are subject to Reverse Charge VAT in UAE.

What Is Reverse Charge Mechanism in UAE?

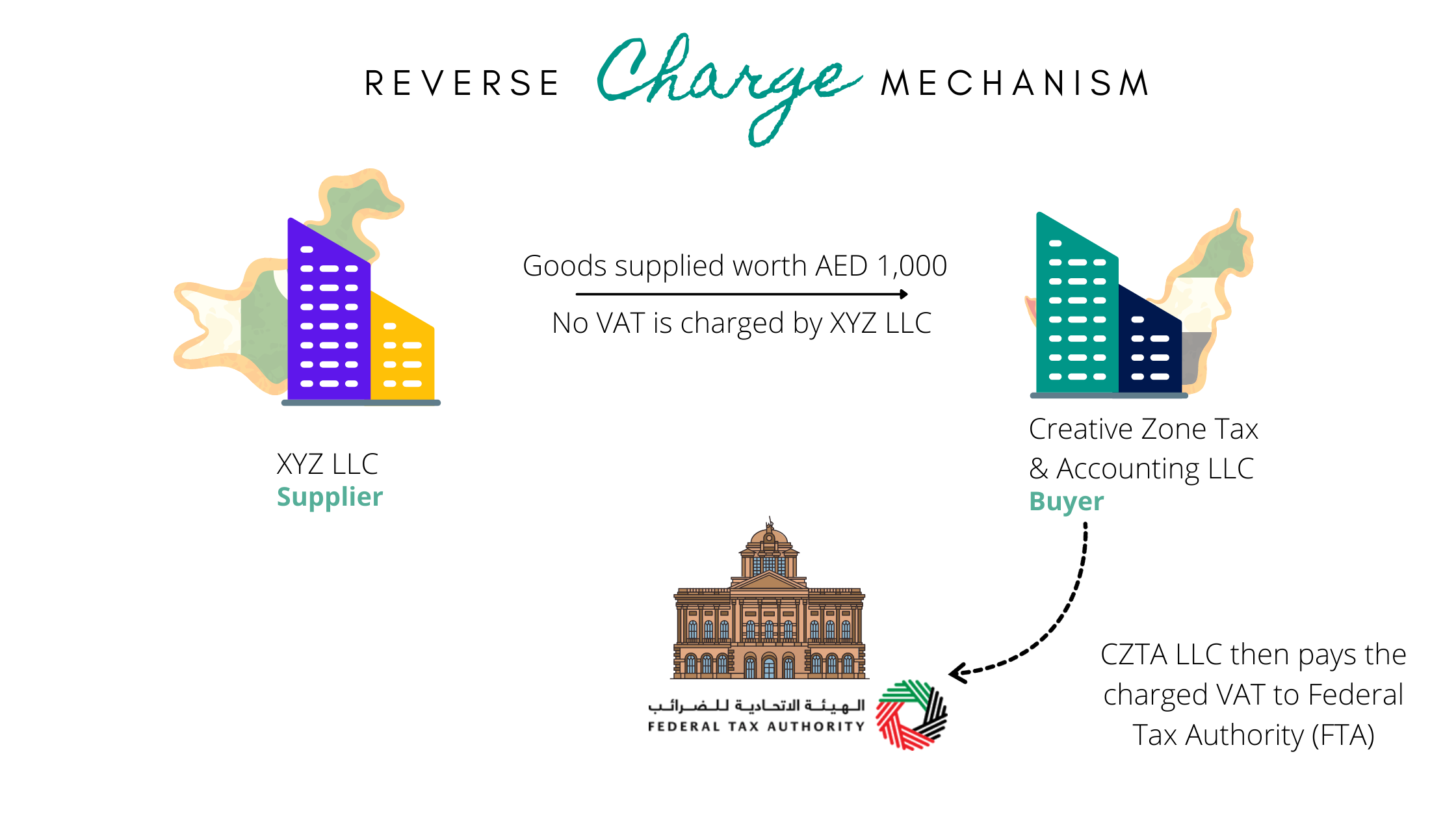

When a reverse charge mechanism is used, the recipient or buyer of notified supplies is responsible for paying the tax, as opposed to when a forward charge mechanism is used, where the supplier is liable for paying the tax. The most significant change is that the buyer is now responsible for paying the tax, rather than the supplier.

The government has introduced the concept of reverse charging, which ensures that VAT is collected on goods or services imported and supplied within the state of UAE even if the supplier is not a taxable person. In this case, the recipient or buyer is treated as if he or she were creating taxable supplies for himself, so the government will have to collect VAT from him or her.

What Is The Purpose Of Reverse Charge Mechanism In UAE?

The Federal Tax Authority (FTA) finds it difficult to track suppliers’ business transactions and ensure VAT compliance when transactions are not taking place in the UAE. Thus, recipients who reside in the UAE will be charged for VAT on a reverse charge basis. Such methods of charging are mainly employed in international transactions. Suppliers who are not residents in UAE do not have to register or account for VAT where their buyers are located.

Are There Any Supplies In UAE That Are Subject To Reverse Charge Vat?

For UAE VAT, imports of concerned products or services and supplies of any crude or refined oil, unprocessed or processed natural gas, and any hydrocarbon for resale or for the production of an energy product or service are subject to reverse charge taxes. The following supplies are listed in UAE VAT Law as having a reverse charge mechanism that will be liable for VAT if certain requirements are met, according to UAE Executive Regulations:

- For business purposes, concerned of related goods or services

- Supplies of crude oil, refined oil, unprocessed natural gas, or any hydrocarbon to registered buyers or for resale or to be used to produce and distribute any form of energy taxable under UAE law

- Goods or services supplied by a supplier without a residentship in the state to a resident who is a taxable person in the state.

- Goods/services imported from other Gulf Cooperation Council and non-GCC countries. Located in another country, this supplier may or may not have an established business in the UAE.

- Goods purchased from designated zones

- Supply of gold and diamonds

There is a reverse charge mechanism for all of the above-mentioned supplies. For each of the above supplies, however, there are specific conditions that must be met to be eligible for reverse charge VAT, as stated in the UAE VAT Executive Regulations.

How should you respond if you are the recipient of a reverse charge transaction?

The amount of tax you must pay to the government should be calculated (i.e. a 5% VAT rate), the VAT amount should be self-accounted as output tax during the purchase, and the VAT amount should then be reported in your VAT return. The possibility of claiming input credit exists. Keep your invoices for future reference in case an input credit claim is necessary.

An Example Of The Reverse Charge Mechanism For VAT

UAE VAT introduced the concept of Reverse Charge Mechanism in order to collect VAT from suppliers who are not taxable in the state. As a result, the government will be liable for collecting tax from the buyer or recipient of goods or services. The following responsibility must be discharged as a recipient or buyer of goods or services under reverse charge mechanisms:

- Estimate the VAT due based on the value of the item

- Ensure that the correct VAT is accounted for when reverse charge supplies are made

- VAT should be remitted to the government

- Tax on inputs may be claimed if eligible

- Obtain and keep records to substantiate claims for tax payments and input taxes such as invoices and other documents

Let us look at an example to better understand the concept of VAT Reverse Charging:

Dubai-based Creative Zone Tax & Accounting LLC, a provider of business accounting and consulting services, acquired IT equipment and other assets worth AED 1,000 from XYZ LLC, a Pakistani company. In this case XYZ LLC is not registered for VAT purposes in the UAE. Therefore, the buyer which in this case is Creative Zone Tax & Accounting LLC shall charge 5% VAT (AED 50) on AED 1,000 and pay to the UAE government.

Moreover, Creative Zone Tax & Accounting LLC has the option of claiming AED 50 as input tax, which can then be offset with output tax due.

An accounting firm with reputable VAT consultants in Dubai that is rated as amongst UAEs top rated accounting firms will provide a more in-depth explanation and practical application of the provision to your business.